Water damage claims represent one of the most common categories of homeowners and commercial property insurance filings. Successfully navigating the claims process requires understanding what insurance policies typically cover, what documentation insurers need, and how professional leak detection supports claim outcomes. This knowledge helps policyholders avoid common pitfalls that lead to claim denials or underpayment.

Most property insurance policies cover sudden and accidental water damage while excluding damage from gradual deterioration, deferred maintenance, or flooding. The distinction matters significantly for leak claims. A supply line that bursts unexpectedly typically qualifies for coverage. A supply line that leaked slowly for months, causing mold and structural damage through prolonged moisture exposure, may face coverage challenges. Professional leak detection that documents when damage likely occurred can support sudden loss claims.

Insurance adjusters evaluate claims based on three primary questions: Is the loss covered under the policy? What caused the damage? What is the extent of the damage? Leak detection reports that clearly identify the water source, explain the failure mechanism, and document affected areas directly address these questions. Reports lacking specificity leave adjusters to make assumptions that may not favor the policyholder.

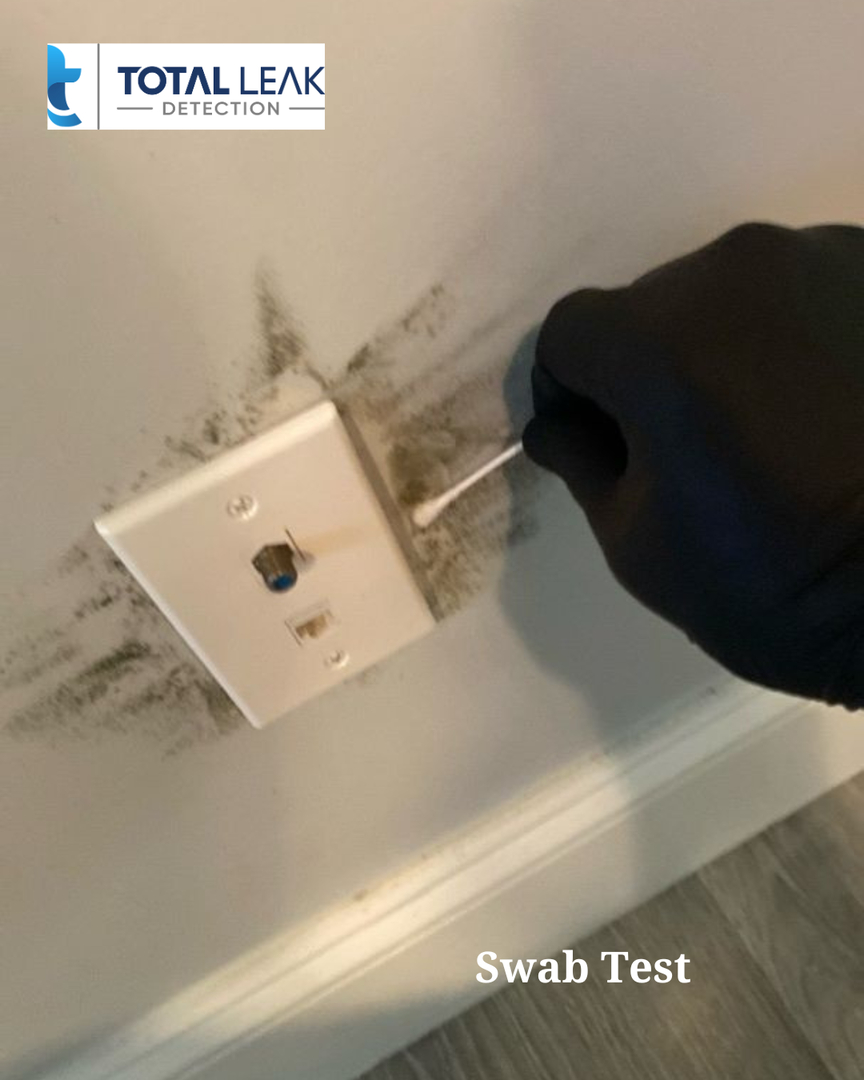

Photographic and video documentation captures conditions at the time of discovery and during investigation. Moisture readings quantify the extent of water migration through building materials. Thermal images visualize water distribution patterns. Together, this documentation creates a factual record that supports claim narratives.

Timing affects claim outcomes. Insurance policies require prompt notification of losses and reasonable efforts to mitigate ongoing damage. Delaying leak detection while damage continues expanding can create coverage disputes. Conversely, thorough investigation before filing ensures the claim accurately represents the full scope of loss.

Coordination with restoration contractors, public adjusters, and insurance company representatives often involves leak detection findings. Understanding how different parties use this information helps property owners manage the claims process effectively.

Articles under this tag explore insurance claim processes, documentation requirements, and common coverage issues related to water damage.